Panic of 1857

Episode #1 of the course “World’s biggest financial crises”

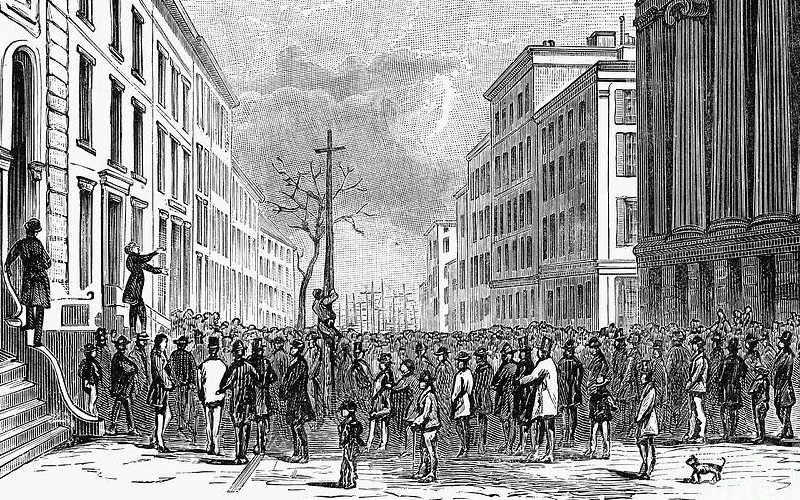

Following the Mexican War, America experienced an economic boom that ended abruptly with the Panic of 1857. Several factors contributed to the crisis, but the key event was the failure of the Ohio Life Insurance and Trust Company, a major financial institution that collapsed because of embezzlement. Shortly thereafter, British investors removed their investments from American banks, causing unease among Americans as to whether the banks and the banking institutions were sound.

Manufactured products were not selling and simply sat in warehouses, which caused layoffs. The railroad also declined, perhaps resulting from overbuilding; as the railroad declined, so did land values. This meant that those who had bought land as investments were now struggling to stay afloat. Grain prices fell, bringing poverty to even the more remote, rural areas. The stock market plummeted.

People began to pull their money out of the banking system in an attempt to protect themselves from losing everything. However, banks at that time used gold and silver instead of paper money. (It also did not help that a boat loaded with gold on its way to the East Coast from California sank when it encountered a hurricane.) Roughly 30,000 pounds of gold sank into the ocean, and nearly 400 people lost their lives.

The panic triggered an economic depression that lasted for at least three years, and the United States really only came out of it after the Civil War began. The south was less affected by the depression, which for some was evidence that their economic policies were better than those used in the north.

Share with friends