Monetarism

Episode #10 of the course “Brief History of Economic Thought”

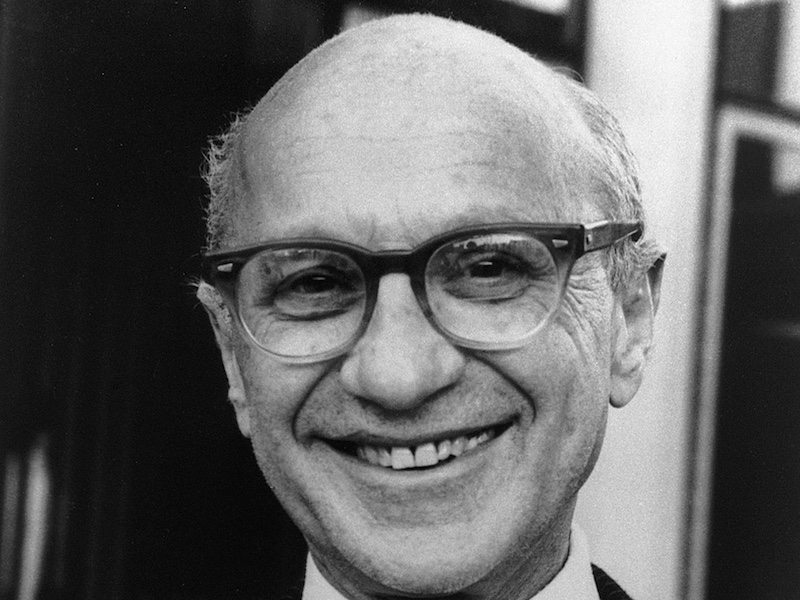

Founded by Keynesian economists who criticized some of the functions of that theory, monetarism is a macroeconomic theory that focuses on inflation, banking, and the central value of money as controlled and regulated by the government. Its founder, American economist Milton Friedman, later won the Nobel Prize for Economics after his mid-20th century reinterpretation of Keynesian economics and its understanding of unemployment and inflation. Friedman served as an important economic and financial advisor throughout the latter half of the 20th century to US President Ronald Reagan and UK Prime Minister Margaret Thatcher. Both these politicians would often seek Friedman’s advice on global economic policy.

Friedman and other monetarist economists propose a central bank that regulates the flow of money to control the rate of inflation. Although Friedman’s ideal system would not have created a central Federal Reserve banking system, he argued that equipping it with regulatory powers was the best way to make use of the system in place. A philosophy that mainly supports a governmental laissez-faire policy, monetarism focuses on price stabilization and active manipulation of the money supply. By tying together inflation and unemployment, monetarist economists showed that money did, despite Keynesian economic principles, “matter,” and that inflation was always a monetary phenomenon.

Friedman’s policies have remained active in the contemporary financial crisis. Many economists today accept his theories as part of mainstream economics and as essential to subsequent theories, such as decision theory and price theory. Friedman was the first to argue the quantity theory of money—that when individuals were faced with a surplus, they would increase their own spending, but during an economic contraction they would react by re-establishing their saved surplus.

Share with friends