Real Estate Market Cycle 101: Part 2

Episode #7 of the course Real estate investing essentials by Symon He

Hey, welcome to Lesson 7!

Today, we’ll cover the remaining two phases of the real estate cycle. Let’s start with hypersupply.

Hypersupply Phase

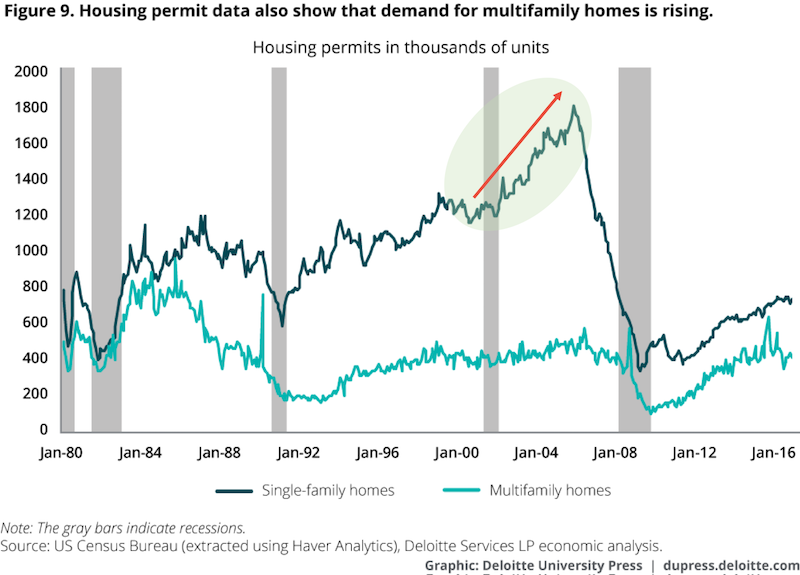

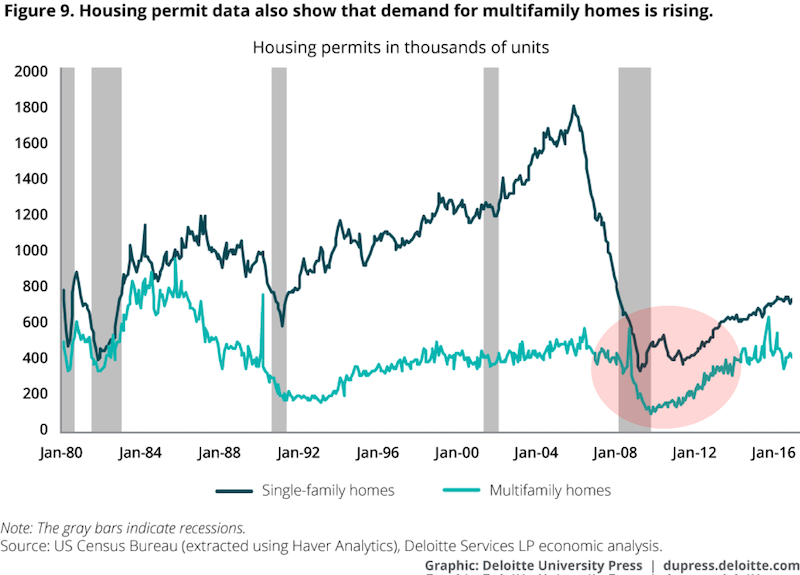

During the expansion, economic growth continues to drive demand and push vacancy rates lower in real estate, driving rents up. As long as rents continue to trend upward, new construction will continue to look financially attractive for investors, drawing ever more investment dollars into the market. This leads to not just more more supply of new units but also to rising property prices, as buyers bid up the values of existing inventory. Look at the hypersupply phase from 2003 to 2006, when permits housing starts shot way up.

This was much more the case for single family homes than for multifamily apartments due to the outsized profits homebuilders were getting.

So, how we know when we’ve finally crossed from expansion into hypersupply mode?

When there is an increase in unsold inventory in the market.

This occurs as new completions from the mid and late expansion phase begin to saturate the market with a glut of new inventory, far more than the market demand could support at the current property prices.

Because vacancy rates are still well below the long-term average, rents are still rising, but the rate at which they are rising slows down: Rent growth is no longer accelerating, but rather decelerating until ultimately, it reverses direction and we see vacancy rates start to go up again.

This is the clearest sign of a shift in the market—when rental growth decelerates. But because investors will continue building and bidding up property values until it’s too late, the market crashes and we enter the recession phase.

Recession Phase

The glut of new supply finally overpowers the market, driving rents and prices down, and vacancies start to climb.

Here, the transition from the hypersupply (the boom) cycle to the recession occurs when rental growth rate slows to zero and becomes negative (i.e., rents begin to fall), while vacancy rates start to increase and rise above the long-term average rates.

New construction finally dries up and fewer new projects start (from 2008-2012, where housing permits for new construction fall by nearly 80% from peak levels).

But the many projects started during the tail end of the building boom continue to saturate the market. The continued addition of inventory leads to more vacancies and lower rents.

Finally, in an effort to address rising inflation concerns due to the recent boom, the Federal Reserve may even start to raise interest rates, which will make financing more expensive and help further accelerate an end to the boom.

The combination of higher vacancies, lower rent received on those occupied units, and increased interest expenses on more expensive financing will quickly make deals less profitable and less appetizing to investors. Property values then begin a steep decline as property values fall, sometimes as much as 50% or more from peak values. Depending on the market, property values can take up to three to five years to hit bottom.

Smart and savvy investors, who have predicted and planned for all this, would have sold their properties well before the peak, being conservative to not risk getting caught in the crash. They were getting out as early as 2003 and were mostly in cash before 2006. Then they acquired property at their lowest prices between 2009 through 2012, sometimes getting properties at pennies on the dollar.

Where Are We Now?

It’s important to remember that the Great Recession of 2008 wasn’t entirely unpredictable and unforeseeable. Based on what we’ve learned so far, that crash happened almost on schedule.

Today, most real estate markets are well into the expansion phase. Some even appear to be entering the hypersupply phase, with the significant jump in building activity and inventory in the pipeline.

With the crash of 2008 fresh on our minds, we hope to always be wary of the next major crash. But if the real estate cycle holds true, then that won’t happen until after the next peak, around 2023/2024, with a recession or crash coming in around 2026. Property values should then bottom out around the year 2030.

Between now and then, aside from the occasional slow down and inevitable market hiccups, the real estate industry is likely to enjoy a long period of expansion.

Tomorrow, we’ll explore three approaches to valuing a property.

Thanks!

Symon

Recommended book

The Unofficial Guide to Real Estate Investing by Spencer Strauss, Martin Stone