Real Estate Market Cycle 101: Part 1

Episode #6 of the course Real estate investing essentials by Symon He

Hey, welcome to Lesson 6!

Today, we’re going to cover two of the four phases in the real estate market cycle.

Could we have predicted the housing crash of 2018? And with some reliable degree of accuracy? Probably.

But to understand what happened, we have to go all the way back to the late 1800s, when a man by the name of Henry George first noticed a very peculiar yet seemingly consistent 18-year cycle through which real estate markets seem to move. With few exceptions only during periods of extreme social and economic turmoil (e.g., World War II and the hyperinflationary years in 1970s that led to a mid-cycle peak), this cycle has repeated itself for over almost 200 years (see below).

| Peaks in Land Value Cycle | Interval (years) | Peaks in Construction Cycle | Interval (years) |

| 1818 | — | — | — |

| 1836 | 18 | 1836 | — |

| 1854 | 18 | 1856 | 20 |

| 1872 | 18 | 1871 | 15 |

| 1890 | 18 | 1892 | 21 |

| 1907 | 17 | 1909 | 17 |

| 1925 | 18 | 1925 | 16 |

| 1973 | 48 | 1972 | 47 |

| 1979 | 6 | 1978 | 6 |

| 1989 | 10 | 1986 | 8 |

| 2006 | 17 | 2006 | 20 |

Source: Fred E. Foldvary, “The Depression of 2008”

Before we try to predict when the next boom and ultimate crash, let’s look at the first two phases of the cycle.

Recovery Phase

Since the recent real estate crash that bottomed out in 2011 for most markets in the US, we’ve been on a consistent and steady recovery ever since. In fact, some markets are already back to their 2006 peak year highs in terms of property values. A recovery is also typically further fueled by government intervention in the form of lowered interest rates, which has been at or near historical lows over this past decade, thus shortening the impact and duration of the recession and speeding up the recovery due to easier access to cheap financing for home buyers.

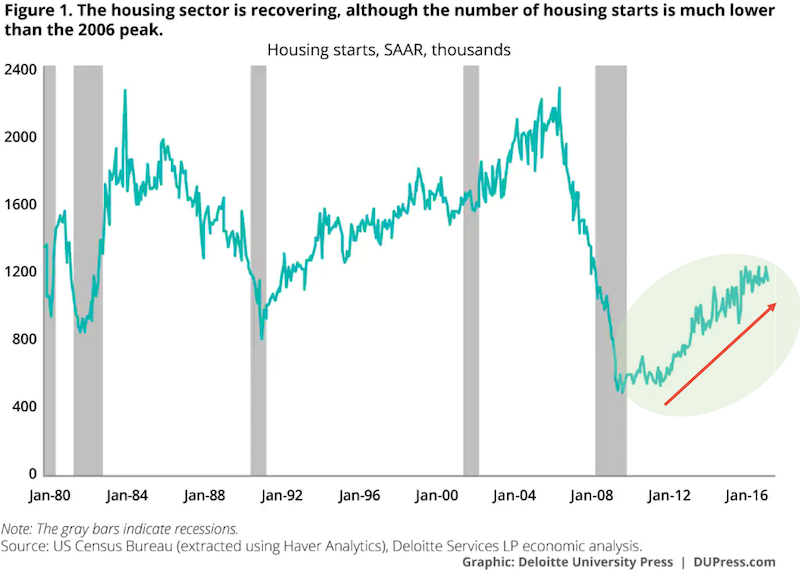

With increasing demand and lower investment costs, companies expand their businesses. They hire more people, open new headquarters, rent more office space, buy more equipment, etc. The adding of jobs drives residential demand, driving up rents and property values. Home builders slowly start to build more again, as we can see in the steady climb in housing starts since 2012.

Vacancies across all real estate asset classes (office, retail, residential, etc.) will begin to decrease as companies use previously empty buildings and more people move into previously vacant homes.

By 2018, with more new construction permits issued, we’ve clearly entered the expansion phase in most markets.

Expansion Phase

With vacancies in many markets beginning to approach their lowest points since 2007, the transition from recovery to expansion phase has taken hold by 2018. During the expansion phase, we’ll see occupancy begin to exceed the long-term average. As vacancies drop, property owners will begin to raise rents. We’re already seeing double-digit rental growth in both the commercial and residential markets the last couple years.

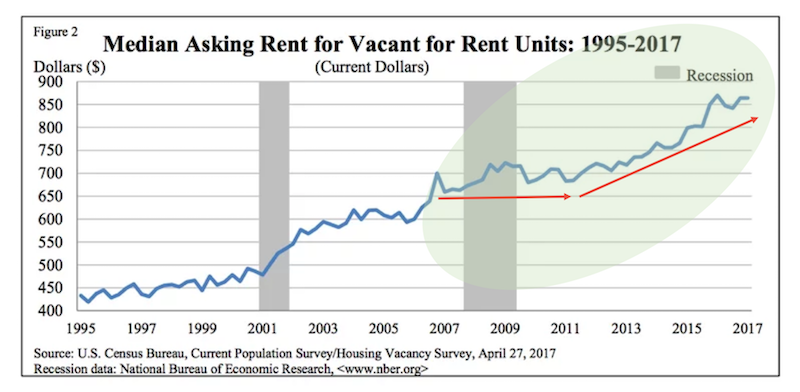

As rents go up, so do profits. Increased profits then attract more builders, developers, and investors who will want a larger piece of this growing profit pie. As we can see from the chart below, rental rates have steadily risen since 2012, after staying relatively flat from 2007-2011.

But won’t the laws of supply and demand kick in to curb the rise in profits? Yes, it will eventually. It just takes time in real estate. Any new supply (of homes, apartments, offices, etc.), takes time to come into the market. Deals must be negotiated, studies conducted, land graded, permits applied for and obtained, financing secured … all these things are not easy, as banks can still be overly cautious during this period, since the recession is still fresh on their books.

Even with financing, many construction projects take years to complete, especially for commercial real estate. Meaning that during the first years of expansion, demand will begin outpace supply, leading to ever-increasing occupancy and higher rents.

But rents won’t just be growing, it will grow faster, year over year. It will be accelerating. And as investors get more aggressive with their underwriting assuming this rental growth, they drive up sale prices, creating a buying frenzy and ultimately, the next big market boom.

Right now in 2018, we appear to be well into the expansion phase and will likely see continued expansion through 2020, at which time, we’ll likely enter the next phase: hypersupply

Tomorrow, we’ll cover that, as well as the dreaded recession phase.

Thanks!

Symon

Recommended book