Mortgages Pt. 2

Episode #6 of the course Personal finance concepts by Maureen McGuinness

There are two main types of mortgages for US-based individuals with a downpayment.

Adjustable-rate. The interest rate varies throughout the term of your mortgage. This type of mortgage usually provides a period of five or seven years at the start of the term where you pay a fixed rate of interest (usually lower than fixed-rate products). After the initial period your rate will re-adjust annually depending on market conditions and usually with caps on how much it can increase in a given year.

Fixed-rate. The interest rate remains fixed throughout the term of your mortgage. It doesn’t matter whether you take out a 20-year, 25-year, or 30-year term, you’ll be fixed throughout.

No Downpayment

If you don’t have a downpayment of 20% and your credit score isn’t very strong (more on this in Lesson 8: Credit Score), you have a few more products available:

Conventional 97 LTV. A loan through Fannie Mae and Freddie Mac requiring as little as 3% downpayment is available. This loan can only be taken out on 30-year, fixed-rate mortgages.

FHA Loan. A loan backed by the Federal Housing Administration. You can put down as little as 3.5%. Your interest rate may be higher.

VA Loan. If you are a veteran, you and your family can take out a loan without putting any money down. One-time funding fees apply, but you can reduce these fees if you make a downpayment.

For UK-based individuals, there is a larger range of mortgages:

Standard Variable Rate. The interest you pay on this mortgage varies each month, often in proportion to the Bank of England’s base rate.

Fixed Rate. The interest remains fixed throughout a previously agreed term. You can usually fix for two years, five years, and less often, ten years on the same rate. After the agreed term, your mortgage may automatically switch to a standard variable rate.

Tracker. The interest rate stays directly proportional to another base interest rate, plus a few percentage points.

Discount. Similar to a standard variable rate but commonly offered to new customers or first-time buyers. You get a discount on the rate that has to be paid back.

Capped. Similar to a standard variable rate but comes with an interest rate cap.

Offset. You link a savings account with a mortgage and the savings can be offset against what you still owe the bank, reducing the amount of interest you pay.

If you’re not based in the US or UK, you can search for Mortgage Types [Your Country] for full details.

Term

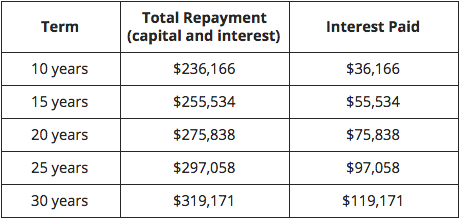

In Lesson 1, we saw how compound interest can also work against you if it’s applied to any debt that you have. A mortgage is a type of debt. The longer you have debt, the longer you will be paying interest and the more interest you will pay over the term of the loan. If you borrowed $200,000 charging 3.4% interest as a mortgage on a property, here’s what you could pay:

It can be tempting to take out a longer term on your mortgage because your monthly payments are lower, so the loan appears to be cheaper. Always factor in how much interest you’ll pay over the life of the loan to get a more accurate idea of how much your mortgage will cost.

Other Fees

Banks are offering a service and often charge a fee to individuals taking out a mortgage. This can vary from $200 to $1,500. This is usually a one-off fee, but it is something to take into account when saving for a downpayment.

Overpayments

Most mortgage products allow you to overpay on your mortgage. Some don’t. Of those who do, it’s important to know before you agree to a mortgage how much you can overpay (usually expressed as a percentage of your monthly repayment, e.g., 10%) without being fined. Ask the question before you agree to any mortgage to prevent surprises.

In summary, a mortgage is the biggest financial commitment you may make in your lifetime. Take time to build a large downpayment and reduce your costs over the long term.

Recommended book

Share with friends