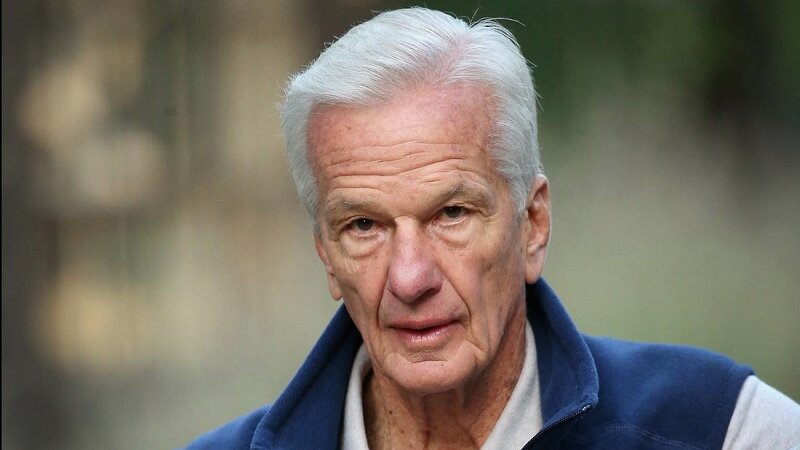

Jorge Lemann: The Percentage Incentive

Episode #8 of the course 10 billionaires and their lessons on success by John Robin

Welcome to our eighth lesson about the world’s billionaires and their lessons on success.

So far, we’ve learned from seven billionaires, and our tour has taken us around the world. Today, I promised we would head to yet another continent—South America—to meet our next billionaire.

Get ready, as we step out of the plane with the beaches of Rio, Brazil, insight!

Jorge Lemann: Poor and Smart with a Desire to Get Rich

At age 80, Jorge Paulo Lemann has spent decades building up his wealth to the $17.5 billion it is today, in August 2020. Though a personal tragedy in 1999 led him to move to Switzerland, where he resides today, his story of success unfolds in his native Brazil.

Considered “a great master” by Warren Buffet, Jorge’s origins go back to 1961, when he returned from Harvard with an economics degree, then headed to Switzerland to work for an investment bank. Jorge was inspired by the percentage incentive model he used at his day job. Rather than just being paid a salary, he earned a bonus based on the percentage success of the investments he managed.

In 1971, he founded his own investment company, Garantia, and left his job to pursue its growth full-time. Jorge understood the power of a percent incentive, so he drew on this in how he hired his staff. Rather than fixed salaries, he offered a minimal, underpaid wage, with a very large bonus. This mostly drew a class of workers he called “PSD”—poor and smart with a desire to get rich.

These workers were driven to increase the investments they managed. Jorge also employed another strategy, learned from Jack Welch of General Electric, called the 20-70-10 principle. In this model, 20% of the highest performing staff are promoted, the middle 70% stay the same, and the lowest 10% are laid off.

From this emerged Jorge’s top power-players, Carlos Sicupira and Marcel Telles. Together, they are known as the “three musketeers”. In 2004, the three of them founded a larger investment firm, called 3G, which has since grown so large it has attracted a partnership with Warren Buffet. Together with Buffet, 3G owns Kraft Foods, Maxwell coffee, Philadelphia cream cheese, Burger King, and Heinz. It’s worth noting though, that, unlike Buffet, Jorge never eats at Burger King.

Jorge’s Billionaire Lesson

Jorge’s success illustrates a concept called percentage stakes. This occurs when you know you will receive a percentage of profit, rather than a fixed income.

Let’s have an example to see how you can apply this to your small business:

Option 1: Fixed stakes. You start a small business and want to be fair to all your employees to keep them loyal. From the start, you guarantee a salary based on a reasonable hourly wage. Annual bonuses are optional and given at your discretion.

The money to pay all your employees is required upfront. This is called overhead. It costs you nearly $1 million to fund your startup for three years, which requires investors and big, high-interest loans.

Option 2: Percentage stakes. You start a small business and remember a lesson from a great Highbrow course. You offer your employees a flat guaranteed income for each job they complete, and a ridiculously high bonus based on profit paid quarterly.

You still require overhead, but it’s only $100,000 for three years of operation to cover the smaller flat fee payments, and you’re able to fund this with a low-interest bank loan and personal savings.

Now, to see which one is better, let’s look at what happens to employees over time:

Option 1: Employees do their jobs as expected. Many move on to better-paying jobs. Company growth is driven largely by advertising, which comes out of profits.

Option 2: Employees who earn the highest annual bonuses are those who go above and beyond in every job. Employees never complain about being paid unfairly because they understand their pay is reflected by company growth, and if their pay is low, they can either work with the team to suggest ways to increase profit or move on if they no longer believe in the company model.

Jorge’s model is actually quite common. The publishing industry, for example, operates on this model. An author is paid a fixed income advance, then they are paid additional royalties annually, as a percentage of book sales.

My own publishing company uses this model, except rather than only authors, we extend this stake to editors, designers, and other team members. Because of this, we attract those most passionate in our vision, and together, the team synergy is staggering, and keeps us growing every year!

Stay tuned for tomorrow, when we’ll be getting on a plane for Australia!

Recommended book

The Little Book of Common Sense Investing by John C. Bogle

Share with friends