Investing Myths

Episode #2 of the course Investing money for beginners by Maureen McGuinness

If you mention investing to a friend, you may be met with a fearful response: “You might lose money in the stock market.” They aren’t wrong. You might lose money in the stock market. But you’d be surprised at how often you win by investing in the stock market.

Similarly, other investing myths can prevent you from creating a portfolio that is right for you. Consider these common investing myths and see if you’ve heard any before.

Myth #1: X is the best investment.

You can replace X with gold, property, or any hot company’s stock, e.g. Google. Don’t put all your eggs in one basket. In spite of headlines, it’s important to remember that investing in one asset can be as risky as betting. No matter how convincing, resist the temptation to invest in the next “hot” company. By the time the news goes live, everybody will have started buying it, which means you won’t be able to buy it at a reasonable price. Getting rich quickly is not investing, it’s speculating and can increase your chances of losing money. There are some individuals who do extremely well by picking one winning stock, but it’s hard to keep this up over the long term.

Myth #2: You will lose money in the stock market.

I heard this a lot when I started investing in the stock market via index funds (which we’ll discuss later in this course). The problem with this comment is that it can be true, but only if you don’t do your research, i.e. if you don’t have a full understanding of what your investing options are. Index funds allow you to invest in the stock market while spreading your risk, so you avoid putting all your eggs in one basket. They also charge some of the lowest fees.

Myth #3: You have to pay more in fees to guarantee strong returns.

Expensive is not a synonym for quality. Like anything you buy, a higher price doesn’t guarantee a higher return on your purchase. Sometimes it’s worth paying a little extra to buy something that appears to be made of a higher quality material, but with investing, a higher fee doesn’t mean you’ll get a strong return. As you’ll learn in this course, one of the ways investors can reduce their returns is by paying a high fee calculated as a percentage of their entire portfolio, which means there’s no cap on how much they might pay to a broker*.

*As an investor, you can only “buy” investments by going through a broker, e.g. a person or company who has access to the market. The broker will charge you a fee for using their service. Similar to a bank, when you invest through a company, you can open an account with them, through which you buy your investments. The company may charge you a fee each time you buy an investment and an annual fee for using their account service.

Know Your Outcome

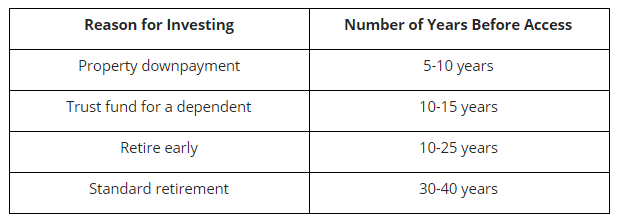

Myths are most effective when you don’t have your own investment strategy. Ask yourself why you’re investing and when you’d like to access the money to help you decide what a suitable portfolio is. Here are a few examples:

In the next lesson, we’ll explore asset classes.

Recommended book

The Intelligent Investor by Benjamin Graham

Share with friends