Identify Your Fundraising Milestones

Episode #8 of the course How to start a startup with zero budget by Dr. Donatas Jonikas

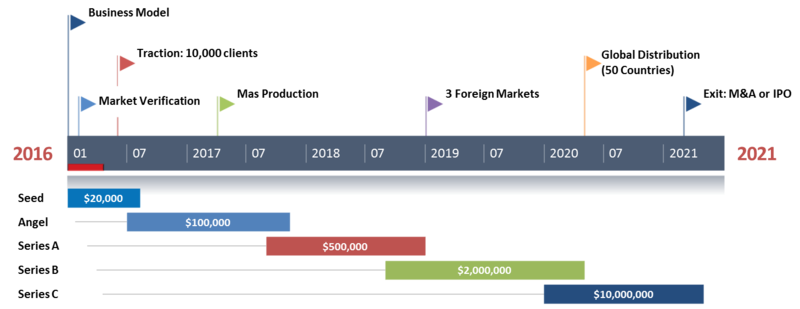

Now that you know your cash-burn rate and needed investment, the first step in preparing to communicate with potential investors is to determine what your cash requirements are over time. The easiest way to do this is by visualizing your company’s cash-burn rate and projected development milestones. Basically, this means you know your startup development milestones and can explain to investors how much money you need, for what purpose, and when you need it. Having a clear picture of your investment needs will make the whole fundraising process more consistent, smoother, and with much greater chance of success.

Different Types of Milestones

Unlike the typical financial goals of any newly established company (that is, sustainable revenue and profit margin), startup milestones are specific events. Usually, they mark the most important points in a startup’s history. Following are the general types of startup milestones:

• Market milestones (first customers, price verification, distribution channel verification, etc) can be defined as gaining proof from market that, for instance, you can effectively reach a target audience of at least ONE million customers, that the product is useful to particular segments (gaining first 100 paying customers), that there is market (gaining first $100,000 in revenue), the business is scalable (growing to $1 million revenue per year), etc.

• Product milestones are related to prototype production, product launch, and updates. The examples could be building a working prototype, delivering the first batch of product to retailers, or introducing an upgraded version of the initial product, providing some kind of major enabler.

• Human resources milestones are attached to hiring or otherwise onboarding key people who will make a strong impact on your startup. Building a full management team would be an example of a human resource milestone.

• Funding milestones include not just the fundraising rounds (contrary to widespread opinion) but also significant proof that your startup is ready for fundraising. For instance, the proof that your business idea is worthy of potential investors’ attention, the proof that you are ready to talk to and negotiate with investors, and the proof that you are efficient with money (you know how to use funds to get the maximum result and you actually do so).

Below is an example of a timeline with startup milestones.

The Best Time for Fundraising

All investors seek to minimize risk without losing the opportunity to invest in a hot startup with huge potential. Investors are looking for the least risky point at which to invest. Therefore, the best time for a startup to seek funding is either right before or right after achieving key milestones. It depends on your chosen potential investor’s attitude. In any case, be sure your fundraising strategy uses these milestones to your benefit, without getting caught between them with no cash in reserve.

Have in mind that investors might make weighted assumptions about ways to reduce your cash-burn rate. Therefore, be ready for a scenario where you will be offered a smaller amount than you are seeking in order to achieve your next key milestone. Usually, this form of communication works quite well:

“This is what I need: {ideal amount of investment you estimate to be sufficient to achieve the next major milestones} to achieve {major milestones you are targeting}, but this is what I can accomplish {one or two smaller yet meaningful milestones} with this {smaller amount} investment.”

Key Takeaway

Once you have a clear picture of your key milestones laid out on a timeline, you should be able to find a variety of points when you could start the fundraising process more efficiently and with a clear perspective of how much money you need, for what purpose, and when it will be needed to develop your startup.

Recommended book

Fundraising Field Guide: A Startup Founder’s Handbook for Venture Capital by Carlos Espinal

Share with friends