Identify and Manage Key Risk Factors

Episode #4 of the course How to start a startup with zero budget by Dr. Donatas Jonikas

Even if you’ve developed your business model that we’ve discussed in the previous lesson, not foreseeing risks might suddenly ruin everything. If you want your startup to achieve success, you must foresee possible risk factors and make decisions in advance about how you will deal with them.

• Can you list the major risks of your business model?

• What parts of your business model are most risk-sensitive?

• What could kill your business?

Identifying Possible Risks

There are many different risk classification methods, but for most startups, the simpler, the better. Analyze each of the following risk groups, and brainstorm what risks your startup might face.

• Market risks refer to whether or not there is sufficient demand for what you have to offer at the price you set.

• Competitive risks are related to what others might do to try to take a share of your business. It’s naive to believe that you don’t have competitors.

• Technology and operational risks generally cover all aspects of execution. For instance, can your team develop and create the product on a limited budget? Will your suppliers be reliable? Can you optimize manufacturing of the product? Will you have an effective support network and infrastructure?

• Financial risks can be described as simply running out of money. Many startups fail because they risk their financial success with the help of outside financing.

• People risks are hardly predictable, but it is clear that people risks are the most crucial and sometimes the least predictable element of a startup.

• Legal and regulatory risks can include various limitations on your business activity, tax complications due to your choice of legal entity or state of incorporation, and industry regulations.

• Systemic risks threaten the viability of entire markets, not just your startup or any other company in the market (for example, an economic downturn or breakthrough technology that renders your ideas obsolete).

Addressing Most Important Risks

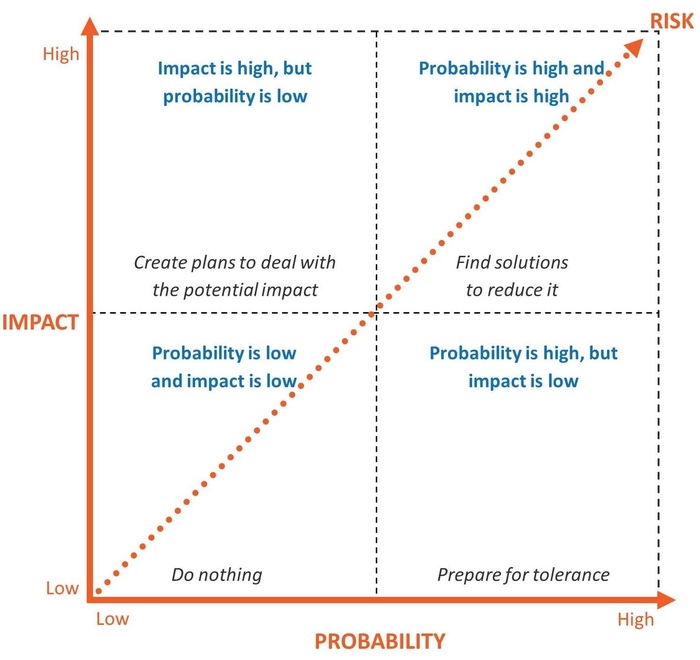

In order to figure out how best to deal with the risks, you can use a simple yet very effective framework for classifying risks. All risks have two dimensions: the likelihood of occurrence and strength of the impact. These two dimensions form four quadrants, which in turn suggest how you should attempt to manage those risks. Use one note for each risk you identified, and place it in the most appropriate quadrant according to the likelihood of the risk and consequences of the risk.

Once you think you’ve thought of all the major risks, explain your business idea to your most pessimistic friends and ask them to find more problems. Although it might be unpleasant to hear criticism, let it be a learning experience. Listen and note if there are any possible reasons for failure you haven’t foreseen. Put them in your plan, and address them according to the risk management matrix that works as guideline in this case (e.g. if you see that probability is low, but the impact would be tremendous, it would be wise to think in advance of what you would do if such risk become reality—what measures you would take in order to reduce negative consequences).

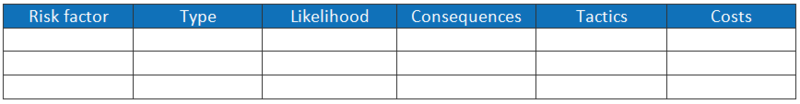

You may find the table below useful for recording and addressing the risks.

Key Takeaway

Don‘t become obsessed with risk management, but identifying the risks you might face and how you will deal with them could save your startup from failure. This will provide you, your partners, and your investors a comprehensive understanding of the potential risks and how your startup is prepared to meet them. The better you prepare this part, the easier it will be to find investors and business partners.

In the next lesson, we will talk about how you should test your assumptions and minimize the risk of your startup failure.

Recommended book

Startup Evolution Curve: From Idea to Profitable and Scalable Business by Donatas Jonikas

Share with friends