Diversification

Episode #10 of the course Investing money for beginners by Maureen McGuinness

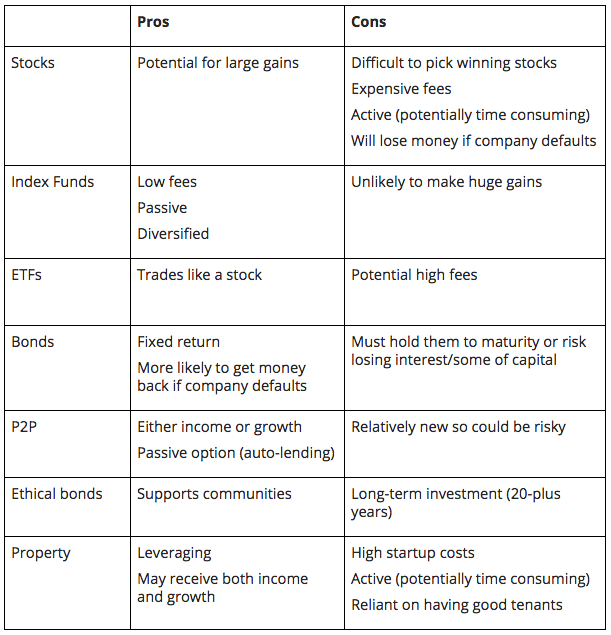

Before we talk about diversification, let’s review the pros and cons of each asset covered in Lessons 3-6.

What Is Diversification?

Diversification is spreading your money across different types of assets to avoid being too exposed to the movements of one market. If you only hold stocks, you’ll be over-exposed to the movements of the stock market, which means you’ll see your portfolio jump up and down over short periods of time. When you diversify, you’ll experience less volatility and earn a steadier return.

Suggested Asset Allocation

So, how much should you be invest in any one asset? Much of investing comes down to your appetite for risk. If you can stomach seeing the value of your portfolio drop by 50% in one day and you are planning to invest over many years, then you may choose to invest 100% in stocks.

If, like me, you wish to sleep soundly every night and can only do so by having small fluctuations daily in the value of your portfolio, then spreading your money across stock index funds, bond index funds, cash (in savings accounts), peer-to-peer lending (both individuals and businesses), and ethical bonds gives you an idea of how much to diversify your portfolio. The asset allocation I’ve just shared is what I currently hold as an investor. When my stock index funds are performing well, my bond index funds are often dropping in value, and vice versa.

No matter how much research you do beforehand, you will never find the perfect asset allocation. It’s important to remember that the longer you wait to start investing, the less you’ll benefit from compounding. To get started, you can use what many investors use: their age as the percentage of their portfolio that they hold in bonds or bond funds (including index) and the rest into stocks or stock funds (including index, ETFs, etc.).

For example, an investor starting aged 25 would hold 25% of their portfolio in bonds/bond funds and 75% in stocks/stock funds. Each year, they would hold 1% more in bonds and 1% less in stocks by either selling or buying.

Rebalancing Your Portfolio

Unlike a savings account, when you invest in the stock market or in P2P, your portfolio will grow and shrink at different times, which means an essential part of investing is to rebalance your portfolio.

Rebalancing helps prevent being overexposed to one asset class. If you’re using your age to determine the percentage of your portfolio, you will find one day that you hold 15% more than you should, which means you could either sell some holdings or increase your stock holdings to rebalance.

Schedule time to rebalance your portfolio. This could be every month, every quarter, or every six months. Some suggest rebalancing when your holding increases or decreases by more than 5%.

You’ve just completed the penultimate lesson for this course. Tomorrow, I’ll be providing you with a checklist to help you apply this information to your circumstances.

Recommended book

Share with friends