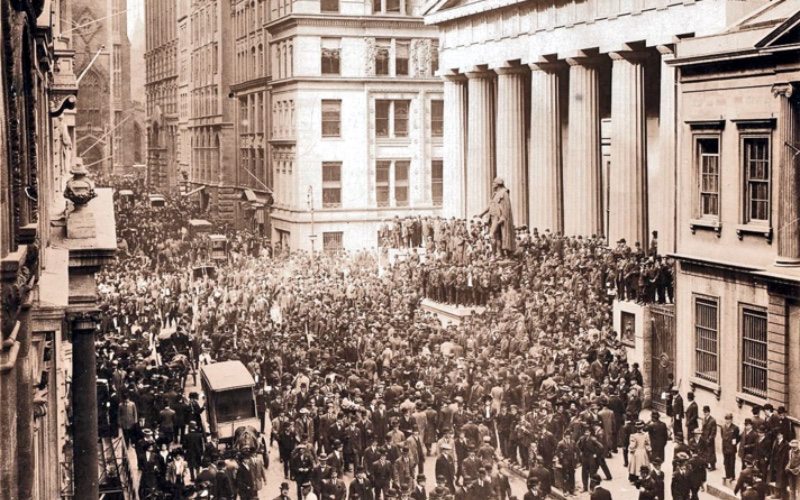

1907 Bankers’ Panic

Episode #3 of the course “World’s biggest financial crises”

The American economic system was healthy for more than 30 years after the Panic of 1873, but the economy began to slow and show signs of weakness again in 1907. Businesses and a few brokerages declared bankruptcy. In October 1907, the Knickerbocker Trust and the Westinghouse Electric Company both failed, starting the Panic of 1907. Some attribute the panic to a plan to limit the reach and popularity of trust companies over the banks. While the plan to bankrupt the Knickerbocker Trust worked, it also made the public believe that another depression was upon them because the banks lacked the ability to liquidate funds.

Stock prices again dropped dramatically, and another bank run ensued. The United States Treasury attempted to curb the effects of the panic by providing millions of dollars to weakened banks, but the collapses continued nonetheless. J.P. Morgan stepped in to offer help. He organized bank officials to help move money from wealthier banks to weaker banks. This effort, combined with the federal government’s $30 million input, essentially stopped the panic and conditions improved within weeks.

This panic led to significant reform in the United States banking system, including the development of the Federal Reserve. The purpose of the “Fed” is to create a central banking system that could provide liquidity to weak banks in times like these. It is supposed to be an independent body that can act without interference of politics. Instead, it has its own internal system of checks and balances through the use of the General Accounting Office and the Office of Management & Budget.

Share with friends