The Balance Sheet: Part 2

Episode #4 of the course Introduction to accounting by Martin Ryan

Yesterday, we learned more about the groups of accounts covered in the balance sheet, also known as the statement of financial position. The account groups were assets, liabilities, and equity. Net profit also came over from the profit and loss. Today, we’ll look at the balance sheet in more detail.

Balance Sheet

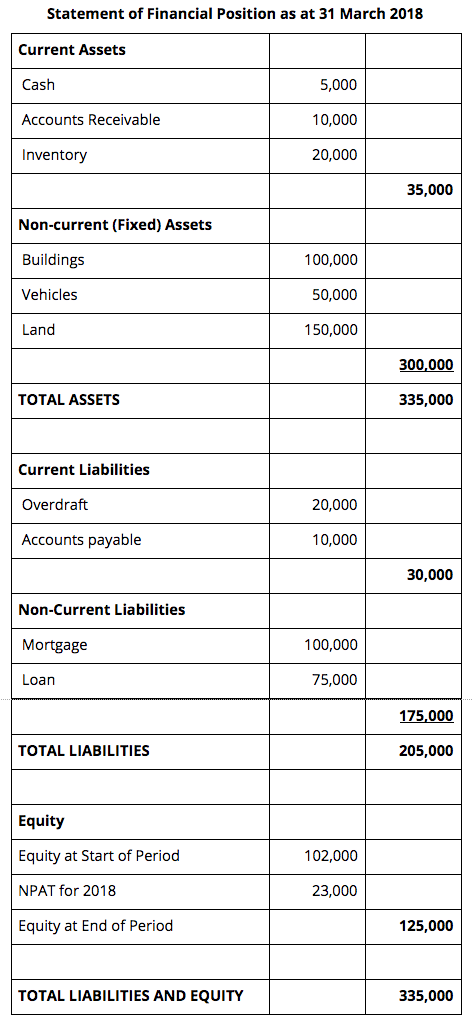

Here’s the example of a balance sheet:

Heading. The first thing to notice is, again, the time frame, which states “as at.” The balance sheet is a snapshot. It details what the assets and liabilities of a company are at a given point in time, not over a period of time, like the profit and loss statement.

Assets. The first set of accounts is the current assets. These are the assets that are likely to be gone, or turned over, in a year’s time. That does not mean there will be zero cash, inventory, or accounts receivable in a year’s time, but there will be different cash, inventory, and accounts receivable in a year. The cash in the bank now will be spent, and there will be other cash there instead.

The second set of accounts is non-current assets. These are the assets that are likely to remain constant for at least a year.

Current and non-current assets add up to give total assets. This is the total for the top half of the balance sheet.

Liabilities. Current and non-current liabilities are similar to their asset counterparts. Current liabilities should have turned over this time next year, and non-current liabilities probably have not, though they may have changed in value—for example, the loan may have been partially paid down.

Equity. Equity is the difference between the assets and liabilities. It is not a cash reserve. This is a common misconception because people talk about taking equity out of the business or putting it in, which they usually do by moving cash. The difference should become clear when we discuss debits and credits in the next lesson.

Equity shows how much of the assets in the business are funded by the owners and the business itself. It can be compared with the liabilities on the balance sheet. If equity is greater than the liabilities, then the company is primarily funded by investors and its own profits, rather than debt.

It Balances

Note that the total assets figure is the same as the total liabilities plus the total equity figure. This is where the name “balance sheet” comes from. The company’s assets balance to the two sources of finance: liabilities and equity.

Liabilities and equity show how the assets were funded. For the assets listed on the top half of your statement, the bottom half will tell you how much was bought by borrowing money from other people (liabilities) and how much was bought with company funds, such as investor funding and reinvested company profits (equity).

Tomorrow, we will start look at double-entry bookkeeping: debits and credits.

Recommended book

The Accounting Game: Basic Accounting Fresh from the Lemonade Stand by Darrell Mullis, Judith Orloff

Share with friends