Product II: How to Talk to Customers

Episode #3 of the course The crash course guide to starting up by Alex Schiff

Hi all,

Yesterday, we covered quite a bit of theory—it was abstract but purposefully so, to give a framework for the march toward Product-Market-Fit.

Today, we’re going to talk about tactics. Specifically, how you can maximize your chance of marching in the right direction by talking to your customers.

Defining Your “Core Belief”

Any product, at any point in its lifecycle, has a “Core Belief” on which it rests.

• Uber: Hailing a cab via your phone can be faster, easier, and cheaper than hailing a cab today.

• Snapchat: People will express themselves more openly if the content they share disappears.

• Zillow: People want to browse homes online before they visit in person.

If the Core Belief isn’t true, the business falls apart, and with each belief, there is a set of dependent beliefs. To take the example of Uber, those dependencies might be:

1. I can create enough density of drivers in a given geography so customers can always get rides when they need one.

2. I can circumvent the regulatory laws around taxi licensing to allow our drivers to operate.

3. A rating system for drivers and riders will create a natural feedback loop to encourage safety and quality, better than a taxi.

Your job is validating these as quickly as possible through customer interviews and market feedback—in essence, to be an anthropologist for your own product.

Pre-product Customer Interviews

These are broad, open-ended conversations with people in your target demographic, during which you are simply trying to gain insight to help you build your product or service. I suggest that you focus on:

1. Behavior and process. Ask people to walk you through their day and describe the experience/responsibilities that you’re interested in from start to finish.

2. Problems. While talking to people, listen for things that sound complex/painful, and then ask them to elaborate on what interests you.

3. Competition. Talk to the customers of your competitors to find out what works, what doesn’t, and what would get them to switch. This will give you much more insight than online research about competitors and their products.

4. Decision-making process. Try to find the answers to the following questions: How do your customers normally evaluate products in your industry? Who evaluates them? Is the end user the same person who cuts the check?

5. Marketing channels. Explore how your customers find out about solutions like yours and what they read and who they trust.

The data you get at this stage will be murky, conflicting, and completely qualitative—but get used to that. :)

Post-Product Customer Interviews

As you start building and releasing early versions of your product, the conversation shifts. Now you have something tangible with which to collect market feedback from real customers. I tell people to be brutally honest and ask about:

1. Expectations, e.g. before you used my product, what were your expectations? What were you looking for it to solve?

2. Experience, e.g. could you please walk me through how you used the product from the time you bought it until the time you were done?

3. Results, e.g. having gone through the experience, did we meet those expectations and solve your problem? Why or why not?

4. Issues, e.g. as you went through the experience, was there anything that didn’t make sense? Anything that you felt was annoying or complicated?

5. Improvements, e.g. was there anything that the product didn’t do that you wish it did? If you had a magic wand and could have this product do anything differently, what would it be?

6. Longevity, e.g. will you be using the product again? Why or why not? How will you use it differently?

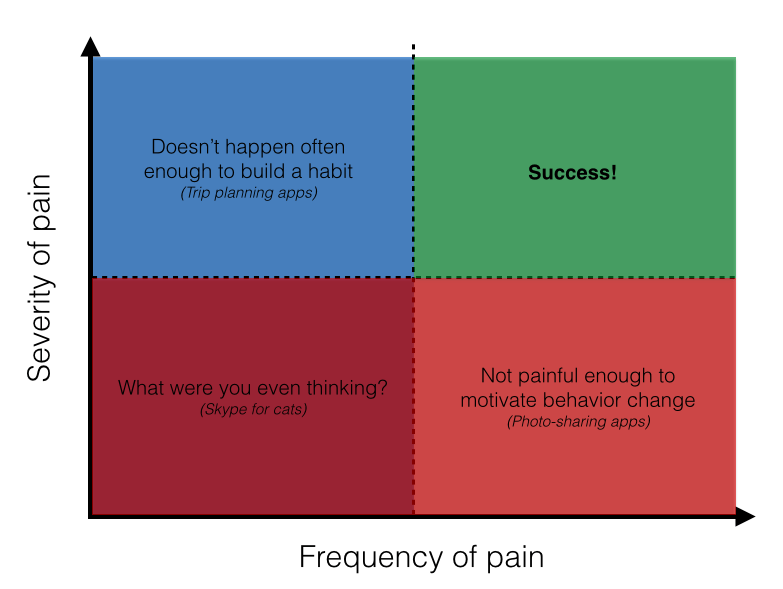

From here, you can take your findings directly back into product development and repeat as many times as necessary. This is a long slog—it can take years and it never really “ends.” I will leave you with one parting piece of advice: When thinking about new ideas, always strive to focus on a customer pain point that is both frequent and acute.

Tomorrow, we’ll cover how to find your first set of customers to test whether or not you’re in the green box!

Onward!

Alex

Recommended book

Share with friends