Marginal Pricing and the Firm

Episode #3 of the course Fundamentals of economics by Dr. Michael McDonald

One of the most important roles of economics in modern business is helping firms understand how to maximize profits. In particular, firms can use economic principles to determine where they should set prices and how they should compete in the market. Today, we’ll talk about the key concept for maximizing profits, called the marginal cost.

The marginal cost of a product is the cost to produce one more unit of a particular product, i.e. the change in total cost when another unit is produced. Similarly, the marginal revenue of a product is the sales a firm gains by making and selling one more unit of the product.

Profit-Maximizing Pricing for a Typical Firm

Firms looking to maximize profit can do so by setting prices so marginal revenue equals the marginal cost of the most expensive unit of product sold by the firm. In other words, the firm should keep producing and selling a product as long as possible and for at least as much as it costs to make.

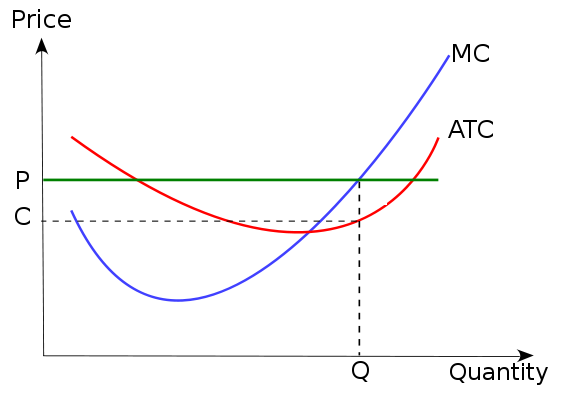

The diagram below shows the profit-maximizing price, where the green line (P, a price) and the blue line (MC, marginal cost) meet. In this scenario, ATC is average total cost, Q is quantity of product sold, and C is the cost of the company’s products.

Essentially, the diagram shows us that firms can maximize their profit—the area of the diagram between points P and C on the vertical axis and Q on the horizontal axis—by setting the green price line so it intersects the blue cost, like at the same point the vertical Q line does. The amount of profit earned is driven by the average total cost of all the products made—the red line below—which is just the cost of making all products dividend by the number of products made.

The concept of profit-maximizing prices sounds simple, but in reality, many firms violate it regularly. Most firms charge all customers the same price for a product—that is, they do not price differentiate, which results in the flat green line. Marginal revenue is always the same, since every customer pays the same price, while the blue line (marginal cost) is U-shaped because initially, firms get economies of scale from producing more of a product, but then eventually, producing more and more becomes increasingly costly.

Think about making furniture as an example of this. Initially, making your own furniture is hard—you probably lack the correct tools and experience. But these hurdles can be overcome, and if you start making furniture full time, it gets easier. Eventually, though, the costs of making furniture start to rise: You would need to hire helpers, perhaps build a large factory, begin shipping materials in from out of state, etc. That increasing expense is the upward sloping blue line.

The key to being a profit-maximizing business is to understand what the marginal cost is and then set pricing accordingly.

Profit-Maximizing Pricing for a Firm with Pricing Power

Firms should operate on the profit-maximization rule regardless of the level of competition they face, but the competition does affect profits at the end of the day.

Firms that face intense competition embrace a situation like the one shown in the graphic above. These firms have to charge the same price to all consumers; otherwise, those consumers will just go a competitor offering a lower price. Firms facing this type of competition usually earn limited profit, if they can earn any at all. In the graphic above, the firm earns a profit equal to the difference between point P (price) and point C (the cost of producing the product, on the vertical axis).

When firms face less competition or can even act as a monopoly (meaning they are the only ones that sell a product), the firm can charge higher prices to some consumers, which results in a larger profit.

The point to remember is that all firms should follow the same economic principles when setting price, regardless of competition. Other factors stemming from competition, like product cost and product demand, dictate whether the firm’s profit is a large one or a small one.

Tomorrow, we will learn how firms estimate demand for a product based on their sales and price and how this can enhance profits.

Recommended book

Share with friends