Fluctuations in the Business Cycle

Episode #3 of the course Introduction to macroeconomics by Doha Soliman, CFA

Welcome to Day 3! Today, we’ll learn the concept of a business cycle and explore what fluctuations entail and how they affect everyone—from the individual consumer (you and me) to businesses and government.

A business cycle, sometimes referred to as the economic cycle, is simply the up and down movements of the gross domestic product (GDP), a measure of an economy’s growth output over a period of time. We will discuss the GDP in more detail in tomorrow’s lesson.

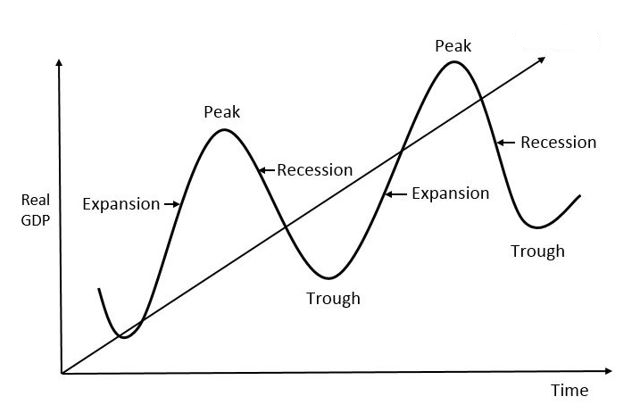

It can be depicted by a graph in which the GDP is a line that fluctuates up or down based on the economy’s progress. GDP and business cycles generally refer to countries as a whole but can also be measured for a region or the entire world.

As seen in the graph above, the y-axis (vertical line) indicates the percent change in the GDP for a given amount of time indicated in the x-axis (horizontal line). It is important to take note that the GDP graph demonstrates the percent change in the GDP and not the actual GDP value. The GDP is a monetary amount that does not provide much insight into an economy, but the GDP graph indicates the increase or decrease of this monetary amount over time, thus providing perspective on the state of the economy’s health.

Phases of Business Cycles

When speaking about business cycles, it is useful to identify the different phases it contains.

Boom: A boom, as the name implies, is a period in which the GDP rises higher than its previous long-term trend. It signifies increased productivity, higher sales, and thus, higher wages. This may result in higher inflation (increase in price of goods and services). Inflation has many repercussions on an economy and will be discussed in more detail in Lesson 5.

Slowdown: A slowdown, the opposite of a boom, is a period marked by decreased GDP, lower sales, lower market demand, and thus, lower inflation.

Recession: This is a period of decline in the output of an economy for two successive quarters. This can have long-lasting effect on wages, the stock market, and the population as a whole.

Recovery (Expansion): This period generally goes after a recession and is a sign of improvements in an economy following a decrease in output.

Depression: This signifies a long-term economic downturn in the activity of a market. It is much more severe and persistent than a recession.

As we will see throughout this course, business cycles are analyzed in much depth by economists, governments, and businesses, as they affect many of the key decisions made for our economy as a whole. While it may sound counterintuitive, some industries profit the most during a recession, while most of the population endures hard times. For instance, discount retailers and used auto dealers profit the most during times of hardship. This is due to consumers seeking out bargains and decreasing their spending on items or services they deem as luxury.

As we wrap up our discussion of economic cycles, in the next lesson, we’ll talk about the Gross Domestic Product and how it differs from Gross National Product.

Learn Something New Every Day

Get smarter with 10-day courses delivered in easy-to-digest emails every morning. Join over 400,000 lifelong learners today!

Recommended book

Capital in the Twenty-First Century by Thomas Piketty and L.J. Ganser

Share with friends