Dos and Don’ts of Debt

Episode #5 of the course Personal financial literacy: Take control of your future by Riley Burger

Welcome back!

Today’s topic is debt—characteristics, types, and how to have a healthy relationship with it. This follows our credit section because by building up your credit score, you can often qualify for lower interest rates on your debts—for large purchases like a house, medical expenses, or an education, this can save you thousands of dollars over your lifetime!

Characteristics of Consumer Debt

Revolving vs. installment: Revolving debt is a line of credit that is renewed once the debt is paid, such as a credit card.

An installment debt is a fixed amount of credit, with fixed payments on that debt until it is paid off, like a mortgage.

Secured vs. unsecured: Secured loans are “secured” by collateral—an asset that the lender can take possession of if you default on the loans. A mortgage is a secured loan, with the house being the asset.

An unsecured loan has no collateral. These often require a high credit score to acquire.

How to Approach Paying off Debts

Pay off debts with the highest interest rates first. This will often be revolving lines of credit like credit cards.

For low-interest-rate debts, compare costs of paying them off to contributing to your savings, but keep in mind that delaying debt repayment can hurt your credit score.

Common Types of Consumer Debt and Important Notes

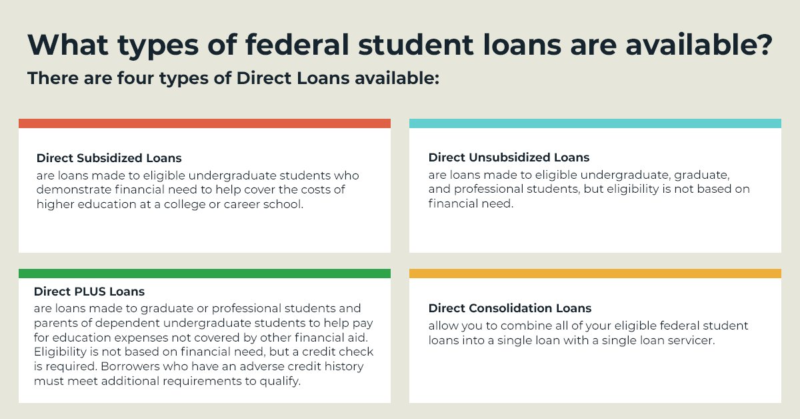

Student loans. There are four types of federal student loans, along with private student loans, and refinancing programs.

Source: studentaid.gov

Private student loans generally have higher interest rates than federal student loans, so it is generally best to use private loans as a last resort after receiving as many grants, scholarships, and federal loans as possible.

Graduated students often refinance their loans once they graduate. This privatizes and combines your student loans, often with a lower interest rate than before. However, refinancing carries risks—you will automatically be disqualified from federal repayment programs, generous payment postponement options, and the long default periods that the federal government provides.

Credit cards. In addition to what we discussed in the last two lessons, keep in mind that credit cards often have very high-interest rates (the average rate for existing accounts in 2020 is 15.1%). This means that if you ever have to choose which debts to pay off first, your best bet will often be your credit card.

Mortgages. Most mortgage loans in the US are repaid over a 30-year period.

Generally speaking, prospective homeowners can afford to finance a property that costs 2-2.5% of their gross income.

If you are looking to get a mortgage, understanding the terminology of the process ensures that you can be a confident self-advocate during the deal. Use resources like Investopedia’s Home Buying Guide.

Medical debt. In most cases, medical debt is unavoidable. Some states charge interest on medical debt. You can often work with the hospital or healthcare provider to set up a payment plan.

Auto loans. Auto loans are secured loans, and the car is the collateral. This means if you default on the loan, your car may be repossessed.

Rates on auto loans are especially flexible to your credit score, giving even more incentive to raise your score.

You can get an auto loan from banks or credit unions, dealerships, and online lenders.

Personal loans. Personal loans are installment loans and can be either secured or unsecured.

These loans can have interest rates as high as 35%, origination fees, and even prepayment penalties (a fee if you repay your loan too early).

While often considered a way to pay off other existing debt or finance smaller cash purchases, it is important to recognize that personal loans are debt. If you can finance that purchase with your savings, you’re likely better off doing that.

Payday loans. A payday loan is a small loan (typically under $1,000) with a high-interest rate and is generally meant to be paid back with your next paycheck. Generally, avoid these loans.

As NerdWallet explains, “the cost of a loan from a storefront payday lender is typically $15 for every $100 borrowed… For a two-week loan, that’s effectively a 391% APR.” Online providers charge even higher interest rates.

Payday loan providers have historically used predatory lending practices, and your debt can escalate very quickly with these loans.

Now that we’ve discussed debts, tomorrow we’ll focus on a topic almost as exciting—taxes!

Until tomorrow,

Riley

Recommended reading

Share with friends