Depreciation

Episode #8 of the course Introduction to accounting by Martin Ryan

Yesterday, we covered the cash flow statement. Today, you’ll learn what depreciation is.

Imagine a car was purchased in 2009 for $20,000, driven for eight years, and then sold in 2017. It was sold for only $8,000—considerably less than the original purchase price. The reason it sold for much less is that it is simply worth less than it was before. This is because the use of the car consumed $12,000 worth of value. This is called depreciation, which is a type of expense. We need to recognize this expense over the eight years that the car has been in use. There are two common ways of doing this.

Straight Line Depreciation

The first and most common way of accounting for depreciation is called “straight line depreciation.” As the name suggests, it deals with depreciation in a linear fashion by spreading the cost equally over the relevant period of time. The calculation is:

(Historical cost of the asset – Salvage value) / Expected lifetime of the asset

Historical cost is the price that was paid for the asset. The salvage value is what is expected to be recovered when the asset is sold at the end of its useful life. This is often zero. The expected lifetime of the asset is how long the asset is expected to be used before it is disposed of.

In the car example, the depreciation calculation is ($20,000 – $8,000) / 8 = $1,500 depreciation per year.

Diminishing Value Depreciation

The other common method of depreciation is diminishing value. This method recognizes that assets often lose the majority of their value in the early stage of their ownership, especially items like mobile phones, laptops, and tablets.

It is calculated as a percentage of the asset’s current book value. Book value is the historical cost less any depreciation that has already been attributed to the asset. For example, book value at the end of year two is historical cost, less depreciation in years one and two. Book value will reduce every year that depreciation is applied.

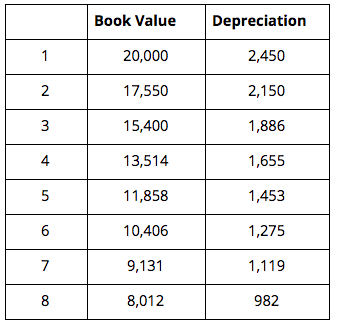

If the previously mentioned car was depreciated using the diminishing value method at 12.25% p.a., the depreciation table would look like this:

Note that when using diminishing value, there is quite a big difference between the depreciation cost in the first year ($2,450) and the last year ($982). Over the course of the eight years, the two different methods arrive at a similar book value; however, the depreciation cost for each year differs.

Matching Principle

The whole point of depreciation is to spread the cost of an asset over its time with the business, rather than as one big expense when it is bought.

To get a little more technical, the reason for spreading the cost is something called the “Matching Principle.” This principle says that revenue should be matched—i.e., recorded at the same time—with the costs incurred in generating that revenue.

The asset value changed over each of the eight years because it was generating revenue for the company, and so that cost should be matched with that revenue and recorded in the same period.

The depreciation method chosen can also depend on what depreciation is primarily viewed as. If it is seen as a way to spread the cost of the asset, then the straight-line method is more appropriate and is in accordance with the matching principle. If it is viewed more as an indication of the value of an asset, then diminishing value may be more appropriate.

Since depreciation is not a cash expense, it does not appear in the cash flow statement. Because it is still an expense, it does appear on the profit and loss statement.

Tomorrow, we’ll look at three ways that a business can be structured.

Recommended book

Narrative and Numbers: The Value of Stories in Business by Aswath Damodaran

Share with friends