Debits and Credits: Part 2

Episode #6 of the course Introduction to accounting by Martin Ryan

Yesterday, we looked at the theory of debits and credits. Today, we’ll go through examples.

Tom’s Rocking Horse Business

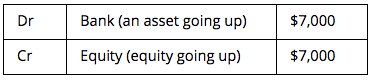

Tom is starting a rocking horse business. He decides to put $7,000 into his new company. The double-entry for this transaction is:

The bank account has increased, which means an asset going up, so the debit side of the transaction goes there. On the credit side, equity was earlier defined as the balancing figure of assets minus liabilities. If Tom put the money in the bank and wound up the company straight away, then he would get the value of the equity back, which is the amount of money he just put in the bank. It is the balancing entry for money provided by the owner.

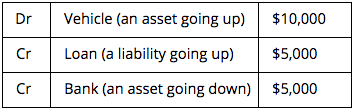

Sometimes the double-entry is a triple (or more) entry. The key point is that the total debits equal the total credits regardless of how many accounts are affected.

For example, Tom wants to buy a car for his business. The car is worth $10,000, but he only uses $5,000 from the bank account and gets a loan for the remaining $5,000. The result looks like this:

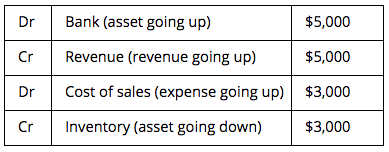

Tom sells $5,000 worth of horses, which cost $3,000 to make. This means two double-entries:

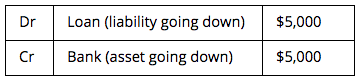

Tom decides to pay back the vehicle loan:

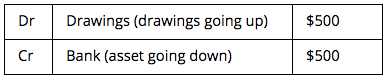

Tom gives himself a pat on the back and takes out $500:

Drawings is like the opposite of equity. Money is being taken out of the business with no benefit to the business—the opposite of what happens when equity goes up. In fact, it is common to just ignore drawings and use equity for money going in or out from or to the owner.

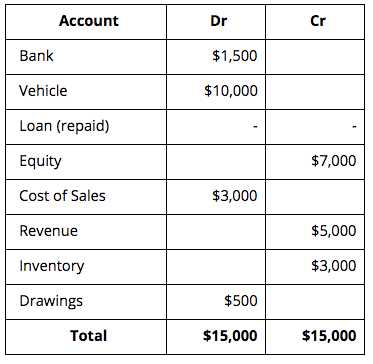

Trial Balance

The trial balance is a summary of all the transactions that have occurred in the accounts over a period of time. Let’s take the examples above. The bank account has been involved in five transactions: two debits (increases) totalling $12,000 and three credits (decreases) totaling $10,500. The net result is the debits outweighing the credits by $1,500. If the other transactions are summarized in a similar fashion, we end up with a complete (albeit small) trial balance:

The trial balance is not an end in itself; the trial balance is used to build the profit and loss and the balance sheet.

All the accounts that fit into the categories of revenue or expenses go into the profit and loss to tell us what our profit is. These accounts are then wiped clean and reset to zero in anticipation of the new financial year.

As we saw in the last chapter, the profit and loss’s resulting figure of profit is sent off to the balance sheet, along with assets, drawings, liabilities, and equity. These four sets of accounts are not reset to zero. They roll over to the next period.

So, the overall process looks as follows:

• Transactions occur throughout the year and are recorded in the format we have seen above: Dr one account, Cr another.

• All the transactions are summed up to give a net figure for each account. This summary is known as the trial balance.

• The trial balance is then used to build the profit and loss statement and balance sheet.

Transactions => Accounts => Trial Balance

Trial Balance => Profit and Loss and Balance Sheet

Tomorrow, we’ll look at the cash flow statement which, as the name suggests, tracks where all the cash goes.

Recommended book

Share with friends