Debits and Credits: Part 1

Episode #5 of the course Introduction to accounting by Martin Ryan

Today and tomorrow, we are going to get into the nuts and bolts of accounting: debits and credits, also known as double-entry bookkeeping.

The Accounting Equation

Together, the six groups of accounts mentioned in the first lesson are the core of accounting, and they make up the accounting equation, which is the focus of this lesson, as it underpins the double-entry bookkeeping system. The accounting equation says:

Assets + Expenses + Drawings

=

Liabilities + Equity + Revenue

This and the next lessons go into some detail in order to show how the concepts of double-entry work, but bear in mind that the aim is only to understand the concepts, not remember all the details.

Debits and Credits

For every action, there is an equal and opposite reaction. This statement is taken from physics, but it applies equally in accounting. For any change that is made in one account, there must be an equal change made in another. This necessity gives rise to debits and credits, also known by their abbreviations, Dr and Cr, and the “double-entry” bookkeeping system.

The kernel of why double-entry accounting exists is held in the proverb, “Money doesn’t grow on trees.” Money has to come from somewhere. For example, if a parent gives their child some money, then the parent has less cash themselves.

If Sally buys a car, then her assets—the car—goes up. On the other side, either her bank balance goes down because she paid cash or the amount she owes goes up because she used vehicle finance or a loan. Money is moving from one place to another.

When a mortgage payment is made, the value of the mortgage owed decreases and so does the bank account from which the money was paid. Again, money is moving from one place to another.

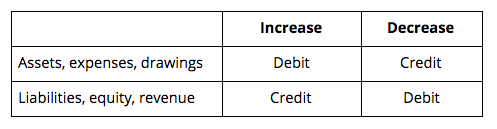

Where it gets a little more complicated in accounting is that the concepts of “increase” and “decrease” do not map directly to “debit” and “credit.” The type of account dictates whether an increase or decrease is a debit or credit. This is shown in the table below. Note how it fits in directly with the accounting equation from the beginning of the chapter. This table, and the accounting equation, is the key to debits and credits. You may find it useful to refer back to when working through the examples.

If the transaction increases an asset, expense, or drawing, then that account is debited. If they decrease, then the account is credited.

Conversely, if a transaction increases a liability, equity, or revenue account, then it is a credit. If any of these three decrease, then the account is debited.

Credit Is in the Eye of the Beholder

You will find in the example tomorrow that an increase in the bank account is noted there as a debit because it is an asset. But on a bank statement, if there is cash in the bank, then the account holder is said to be “in credit.” This appears to be a contradiction, but it is actually a matter of perspective. A positive bank account is an asset to the account holder, but to the bank, it is a liability because they have to pay it back. Hence, the bank will talk about the account being in credit because they owe the account holder money.

The bank has a contractual obligation to pay the account holder the money in their bank account at some point in the future. As noted earlier, that is the definition of a liability, which is why the bank will refer to that account as being in credit.

Thus, debits and credits in accounting terms can take some time to get used to because it necessitates unlearning many years of experience with bank statements.

Tomorrow, we’ll look at a few examples of debits and credits in action and how the transactions they record eventually sum up into the profit and loss and balance sheet statements we’ve already covered.

Recommended book

Share with friends