Cash Flow Statement

Episode #7 of the course Introduction to accounting by Martin Ryan

Today, we’ll talk about the cash flow statement.

The cash flow statement doesn’t get much attention but deserves it. A large percentage of new businesses go out of business in the first few years—not because they are unprofitable, but because they are not generating enough cash coming into their business in order to cover their cash going out.

When investing in a new business, it is essential to get a handle on the concepts that this statement brings to the fore. This is the most important statement when working out budgets; the profit and loss comes second.

The previous section explained that the profit and loss and balance sheet statements result from the trial balance. The cash flow statement does not.

The cash flow statement focuses solely on the bank account and details the inflow and outflow of cash. It is a summary of how the bank account went from its balance at the beginning of the year to the closing balance at the end of the year.

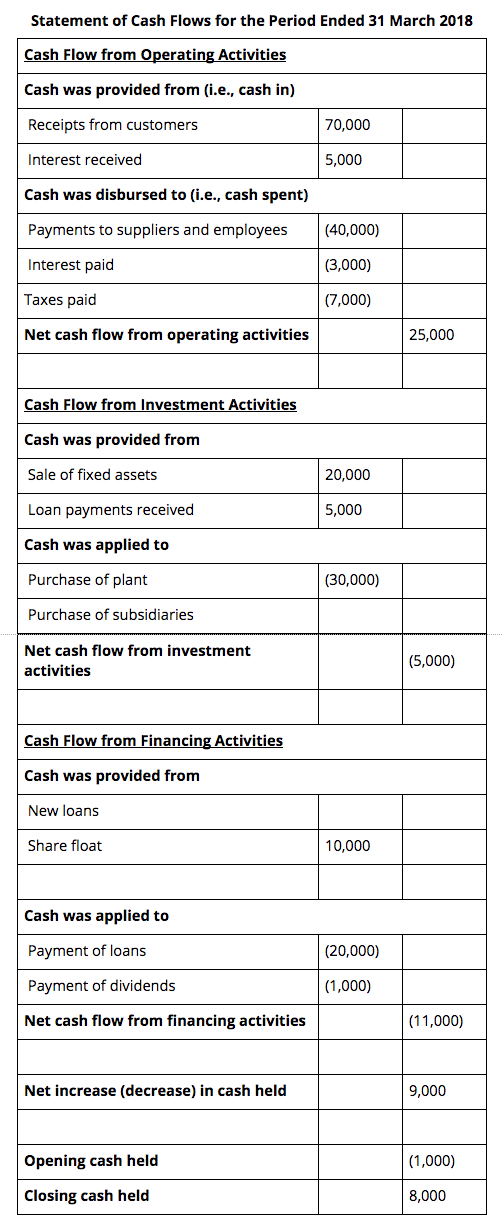

There are three areas where cash moves: operating activities, investment activities, and financing activities. Operating activities relates to the day-to-day running of the business. Investment activities relate to the purchase and sale of assets. Financing activities relate to funding, like loans and share floats (the liabilities and equity from our statement of financial position).

Here’s an example.

So, in the cash flow from operating activities section, it details how the business generated and spent cash through its normal day-to-day operations. The cash flow from investment activities section explains how the change in asset structure affected the cash book: buying and selling assets. The cash flow from financing activities explains how debt and equity—our two sources of external finance—affected the cash flow. Finally, it summarizes this information and shows the net effect on cash.

This statement is critical when it comes to understanding the viability of a business. In fact, when starting up a business, it is a good idea to have a budgeted cash flow statement for every one of the first 24 months.

For a start-up business, one of the main reasons the cash flow statement will differ from the profit and loss is that the purchase of assets needed to start up the business requires cash, but these purchases do not hit the P&L because they are not an expense. This is why a business can appear profitable from the P&L but be losing cash and ultimately becoming non-viable.

Tomorrow, we’ll look into how we deal with assets losing value over time, more commonly known as depreciation.

Recommended book

Share with friends