Track Your Spending

Episode #2 of the course Personal finance concepts by Maureen McGuinness

“What gets measured gets managed.” –Peter Drucker, Writer, Teacher, Management Consultant, and Business Visionary

If you do nothing else related to your money, track your spending. For the best results, you should track your money as early as and for as long as possible. What does tracking your spending mean? Tracking your spending isn’t the same as looking at your bank statements. Tracking your spending means recording every dollar and cent that you spend.

When you don’t track your spending, it’s more difficult to work out:

1. Whether you spend more or less than you earn

2. Whether you’re paying money for something you no longer use (e.g., a subscription)

3. Which expenses add value to your life and which don’t

4. Ways to cut back your spending and increase your saving

When you track your spending, you pay more attention to what you’re spending, knowing you’ll have to write it down. Most transactions, when not tracked, are forgotten as soon as you’ve left the shop or closed your browser.

Tools for Tracking Your Money

Tracking daily is most effective for long-term habit formation. By tracking daily, you’ll also be less likely to miss transactions, and you will have accurate data when you come to review your spending. If you don’t track daily, you’ll need to hold onto receipts and bank statements. What if you’re put off by the thought of an infinite amount of time spent tracking? You’ll be pleased to know that by repeating the action just five times, you’ll be more likely to stick to the habit for a longer period.

Try:

1. Pen and paper

2. An app such as Spendee or Mint

Analyzing the Data

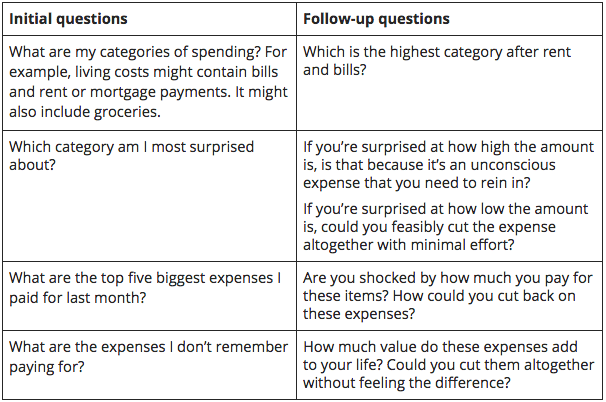

When you look at the data, you might notice immediate flags, like spending the same amount on your car as you do on your rent. You might not notice anything immediately, in which case try using the following questions to dig deeper:

In summary, tracking your spending is the only way you can know where your money goes.

Recommended book

“I Will Teach You To Be Rich” by Ramit Sethi

Share with friends